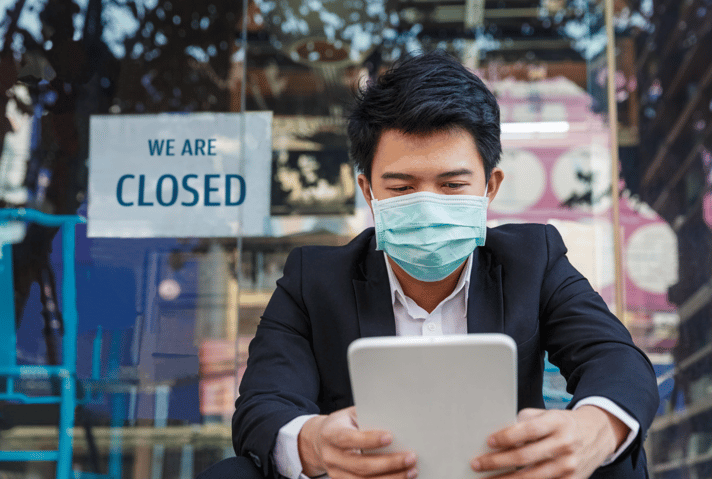

Throughout the COVID-19 pandemic, the government introduced a range of support measures for businesses to help them stay afloat and weather the storm.

Two of the most popular support options were the Bounce Back Loan Scheme (BBLS) and the Coronavirus Business Interruption Loan Scheme (CBILS).

However, a year down the line and many businesses are finding that the loans haven’t been enough for their long-term survival, which leads to the commonly asked question, ‘Can I close a company with a Bounce Back Loan or a Coronavirus Business Interruption Loan?’.

Read on to find out...

Common questions about Bounce Back Loans and Coronavirus Business Interruption Loans

What is a Coronavirus Business Interruption Loan?

The CBILS was introduced to allow small to medium enterprises with an annual turnover of up to £45m to borrow money to help them navigate the pandemic.

Under the scheme, businesses could borrow up to £5m, with the lender having an 80% government-backed guarantee. The loans are repayable over a period of up to six years, and as well as the 80% guarantee, interest and fees were also paid by the government for the first 12 months.

At the discretion of the lender, the scheme could be used for unsecured lending of £250,000 and under, whereas for loans above £250,000, a personal guarantee of some sorts was needed.

What is a Bounce Back Loan?

Following some criticism of the CBILS, the Bounce Back Loan Scheme was introduced to help small businesses gain access to funds more quickly.

Essentially, it was designed to help businesses that were excluded from the CBILS, as well as to speed up and simplify the process of applying for a loan.

Aimed specifically at small businesses, the BBLS gave companies access to loans worth 25% of their turnover, up to a maximum of £50,000. The loans were provided interest-free for the first 12 months, with a rate of 2.5% afterwards at a fixed rate for up to six years.

Unlike the CBILS, with the BBLS the government provided security for 100% of the loan amount, significantly lowering the risk to lenders. It is estimated that over £21bn was borrowed by UK businesses in 2020 as part of the scheme.

So, can I close a company with a Bounce Back Loan or Coronavirus Business Interruption Loan?

To put it simply, yes you can – but the way you close your business will depend on the financial position of your company.

If your business is solvent or can pay off all its debts within a 12-month period, you could choose to dissolve or strike off your business. It’s a relatively simple procedure that sees all creditors paid in full before any remaining proceeds are disbursed among shareholders.

But if your business is facing financial difficulty and you are unable to pay off your debts, dissolution isn’t an option.

In fact, attempting to strike off or dissolve your business if you can’t pay your debts could end up being incredibly expensive and also land you in serious legal trouble.

HMRC could even reinstate your company if it is struck off incorrectly – and they can do so for up to 20 years.

What are my other options, then?

The only feasible way for a business with a BBL, CBIL, or any other debts to close down is through a liquidation.

When you enter into a Creditors Voluntary Liquidation (CVL), a licensed insolvency practitioner will sell the business assets, using the fund to repay creditors in the correct legal order before closing the company down.

The government, then, would become a creditor. However, because there is no security given by a Bounce Back Loan, they would be classed as an unsecured creditor and paid later than other secured creditors. Any remaining debts will then be written off.

Is this the same with a CBILS?

With a Coronavirus Business Interruption Loan, things are slightly different in that what happens to the loan largely depends on whether security or a personal guarantee was provided when the loan was taken out.

As stated above, CBILS loans under £250,000 didn't require security or a guarantee, but if you borrowed more than £250,000 and provided a personal guarantee, you need to check the terms in case you are liable for part of the loan.

If so, the lender will most probably call in the guarantee – and if you can’t afford to pay, you could be pursued through the courts.

What to do next if your company is in trouble

If you are facing financial difficulty due to the pandemic, are struggling to pay back government loans or have decided that the best option is to close your company down, you might be wondering if you can close a company with a Bounce Back Loan.

Remember, if you fail to put the interest of your creditors first in insolvency, you could be accused of wrongful or fraudulent trading – so, it’s important not to bury your head in the sand.

McAlister & Co are here to help so contact us today for free confidential advice on what to do next. Don’t suffer alone; we’re here to help!